Not known Facts About Will I Lose My Tax Refund When Filing Bankruptcy

If you don't pay out the expenses individually, the exceptional stability will continue to expand, and you will owe an important sum at the end of your situation.

I motivate you to look around and I am positive you will locate the data practical. When you might be All set just give us a connect with or electronic mail. We've been in this article that may help you.

Do you have a little organization? Learn the way bankruptcy can assist with your business’s debts and money problems.

The full volume you’ll be allowed to exempt from your suitable assets will usually depend on which state you file your bankruptcy in.

The reality is, declaring bankruptcy will let you to last but not least move ahead with the lifetime. With the Woodbridge law Business of Fisher-Sandler, we assist our clientele fully grasp their legal rights less than U.

As soon as you understand how Chapter thirteen generally is effective, You will probably want additional precise details. You will find extra means for you personally at the end of the post.

Tax period is undoubtedly an eagerly-predicted time of year For lots of people and families – a interval where by The federal government returns economical contributions made throughout the last twelve months. Even so, filing for bankruptcy might make it challenging to receive a refund, so It is really necessary to know when looking at this feature.

. Chapter 13, Adjustment of Debts of somebody With Regular Money, also known as the Wage Earner Program, is created for a person debtor that has a daily supply of income, that enables the debtor to help keep a useful asset, such as a residence That could be in foreclosure or that could have extra equity, and permits the debtor to suggest a “approach” to repay creditors over time – right here generally a few to five years.

If the court approves your approach, you are going to go on creating your proposed payment. Having said that, suppose the trustee or creditor raises a valid objection.

We also reference unique research from other trustworthy publishers the place correct. You are able to find out more about the criteria we comply with in generating correct, impartial information inside our

All reviewers are verified as attorneys as a result of Martindale-Hubbell’s in depth attorney databases. Only attorneys working towards at the very least a few a long time and obtaining a sufficient amount of opinions from fairfax bankruptcy attorney non-affiliated attorneys are eligible to get a Score.

Should you are looking at filing a bankruptcy and anticipate a tax refund, then I like to recommend that you simply speak with an attorney. It is possible to start off this method with me Visit Website for gratis by finishing the web ingestion sort.

Declaring bankruptcy can be a fresh new start for the people in dire money straits. But visit the website not all bankruptcies are the same. Right here, we are going to examine Chapter thirteen, or wage earner's bankruptcy, a plan to repay debts inside a structured way while preserving property.

You could acquire tax refunds while in bankruptcy. Nonetheless, refunds could possibly be subject to delay or accustomed to shell out down your tax debts. try this If you suspect your refund has long been delayed or offset versus your tax debts you could Look at on its status by going to our Where by’s My Refund Device or by making contact with the IRS’ Centralized Insolvency Operations Device at 800-973-0424. The device is accessible Monday by way of Friday from 7 a.m. to 10 p.m. japanese time.

Brandy Then & Now!

Brandy Then & Now! Erik von Detten Then & Now!

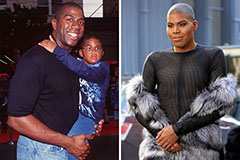

Erik von Detten Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!